Cost overview for the tax return

Where can I find my cost overview for the tax return?

You always receive the tax statement automatically in January.

In mySympany you can download or print the certificate at any time: Menu > Documents > Filter by «Tax statement». Tip: You can also submit your tax return online to your tax authority.

Questions and answers on the cost overview for tax returns

The cost overview for the tax return is only available in the national languages of Switzerland (German, French, Italian).

Invoices that only include non-insured benefits are not listed in the cost overview.

- All those invoices processed by us up to 31 December are listed.

- Reimbursements after 31 December will be listed in the next cost overview.

- Invoices cannot be added subsequently.

- Good to know: you can submit your own statement to the tax authority, but you must then do so every year to avoid double entries.

No, these are not shown in the cost overview for the tax return.

- The amount on the overview page shows the deductible, the retention fee and the hospital contribution. These are costs that were borne by you in 2025. You can find out how this total co-payment is made up on the details page.

- If invoices from previous years were not settled until 2025, the amounts shown in the “Franchise” (deductible) and “Selbstbehalt” (retention fee) columns may be higher than your chosen annual deductible and the statutory retention fee. Further information on deductible and retention fee ›

Please keep all benefit statements you receive during the course of the year in case of any queries from your tax office.

Explanation of the cost overview for the tax return

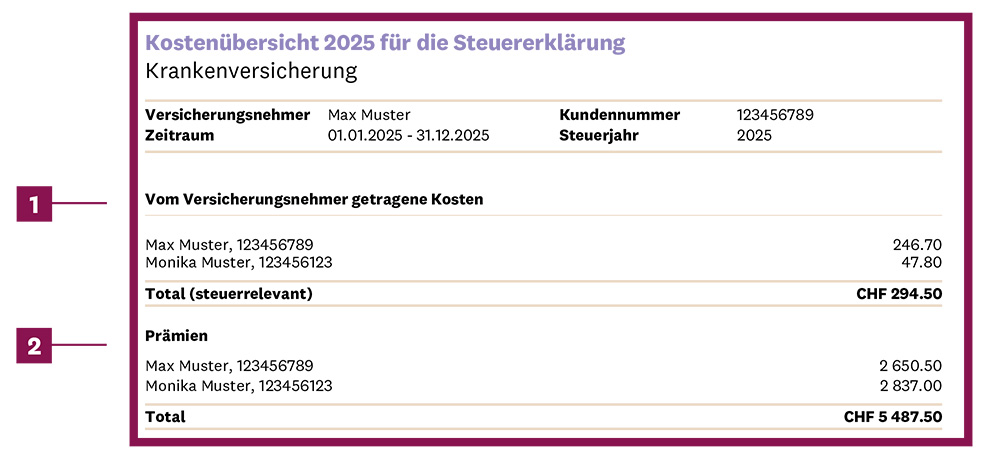

Page 1: costs and premiums

| 1 | Costs borne by the policyholder: Total amount of illness and accident costs that you have paid yourself |

| 2 | Premiums: Total amount of health and accident insurance premiums |

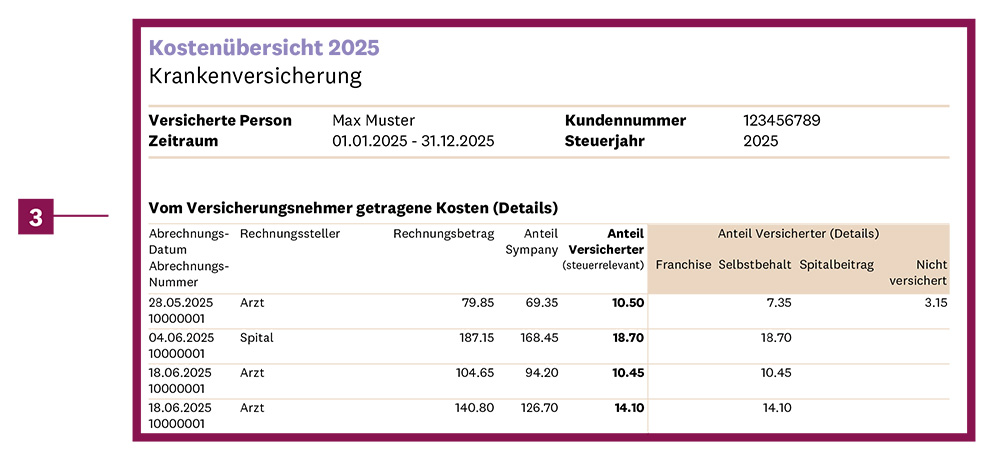

Page 2: details on the costs

| 3 | Costs borne by the policyholder (details): List of all bills processed during the past year, irrespective of the date of treatment, with details of the share of the costs borne by you and by Sympany |